Welcome back to Emerging - exploring the intersection of tech & finance in Emerging Asia. A quick note of gratitude to those of you who continue to spread the word; we saw ~2x subscriber growth in just the last two weeks. Always more fun to write for an audience - so thank you for sharing.

Onto this week:

Exploring the U.S. market for pockets of “under” and “over” financialization as a case study for Emerging Asia

How, contrary to the narrative, financial innovation has lagged “real” innovation during the Information Revolution

Debt & equity - the pitfalls of stagnant funding tools for growth-stage companies

A preview into the expanding financial toolkit and the coming wave of tech-enabled venture asset managers

Finance needs more creativity.

I know that may seem controversial twelve years after a global financial crisis driven by “mortgage-backed securities”, “credit default swaps” and all sorts of overly-complicated derivatives. The “over-financialization” of the economy has been well-documented, pulling many of America’s best and brightest into the world of high finance. Without the ability to build, these intermediaries simply look for more creative ways to divvy up a stagnating pie - using complex jargon to obfuscate limited value-add and increase their rake. Too many allocators & not enough operators.

Or so the narrative goes.

There is clearly some truth here. To quote John Bogle in his speech to Georgetown graduates in 2007:

“25 years ago, financials accounted for only about 6% of the earnings of the S&P 500. 10 years ago, the financial sector share had risen to 20%. And last year, financial sector profits soared to an all-time high of 27%”

The U.S. has not been alone as many “developed” nations have followed a similar trajectory: (noting the share has come down a bit since the 2008 financial crisis)

The relative stability, yet high salaries & bonuses in finance demonstrate a skewed risk-reward which imply a certain degree of rent-seeking or regulatory capture or whatever you want to call it.

I am not denying that.

However, I view finance a bit like tech. Not really one industry or vertical, but a vine that weaves through the others. The infrastructure, ledgers, and incentives which undergird much of the societies we have built. Technological revolutions transform industries, economies, and societies. And capital facilitates technological expansions.

As outlined by Carlota Perez in her now famous book, the dance between financial capital and technological revolutions follow a well-trodden five-stage archetype:

Irruption: Innovations arise which attract profit-seeking, risky capital providers

Frenzy: Capital inflows become irrational & speculation is rampant leading to a financial bubble as financiers over-estimate the near-term potential of the technology

Turning point: The bubble pops. However, the boom from the “installation period” install the infrastructure which paves the way for…

Synergy: Strong growth built on previous infrastructure overspend which allows the new technology to become widely disseminated

Maturity: the technology sees diminishing returns - consolidation ensues, reducing competition; social unrest and search for growth pushes capital to the next wave

Perez outlines the previous five cycles, all spanning ~50+ years, including today’s which began in the 1970s - the Information and Telecommunications Revolution:

My take is we are currently in the “synergy” phase of the information revolution. We had a two-part internet and GFC bubble. Software is in the early innings of “eating the world”. Processing power has disseminated ever-wider, ever-cheaper, in increasingly smaller form-factors: from mainframes to PCs to mobile to wearables. From the U.S. to Europe, to East Asia, to China, to India, to Southeast Asia to Africa, the revolution ripples out ever-wider. COVID-19 is only accelerating our digital shift.

The impact of the information revolution is reverberating around the globe.

Financial Capital Stuck in the 70s

Historically, each technological revolution has been matched by innovations in legislation and capital formation which facilitate the growth and dissemination of the new paradigm:

The 1830s saw joint stock emerge for large projects and the expansion of capital markets

The 1870s+ saw limited liability and legislation for industrial corporations

The post-WWII era saw personal banking services and consumer credit for consumption of mass-produced goods

Cleary, the latest revolution has been boosted by a surge in venture spending and the emergence of new funding models like crowdfunding and ICOs

However, financial innovations have not kept pace with the latest information revolution. A lack of creativity in funding mechanisms is part of the problem.

Perhaps it is not a lack of creativity in financial engineering - the global financial crisis serves as a striking reminder - but a mis-directed energy. Most of our financialization today happens late in a company’s life cycle. The mature stage. When innovation & growth slow, incumbents must pull political or financial or legal levers to stay afloat. The life-cycle of companies artificially extended through lobbying, lawsuits, or financial engineering.

Corporates are not alone. Many “developed”-country governments are guilty as well. The very name reveals a defeatist mentality towards the inevitable idling of innovation. With stalling economic growth, national governments also turn to financial engineering - artificially cheap capital serving as oxygen to Zombie enterprises and rocket fuel for financial speculation. The incentives for making money in the “real” economy diminished, encroaching on the engine of economic growth.

Without “building” its hard to sustain growth. Without growth, things tend to get messy.

So yes, “more smart people should leave finance or law or politics and become engineers” could be part of the solution. Nothing will replace that. However, I feel the cliché has now been parroted more times than Despacito.

The less obvious angle is where financial engineering is not abandoned but moves earlier in the life-cycle of a company. “Real” technological advances will always serve as the primary catalyst, but more thoughtful incentives and tailored financial products have a role to play in company formation and growth.

Beyond Debt & Equity

I’m not against debt and equity. Both are extremely valuable constructs to allocate scarce resources in pursuit of a world which is better tomorrow than it is today. Powerful tools to allow the pooling and exchange of resources between groups of individuals on specified terms. Debt and equity will always have a place in a capitalist system.

However, with the acceleration of technological progress over the last 50 years - the cell phone, the PC, the internet, the operating system, social networks, the smartphone, machine-learning, CRISPR, etc… - the financial products available to individuals, SMEs, startups or growth stage companies appear to have remained disappointingly stagnant.

Largely: Debt or Equity.

Neither are perfect. On the equity side, the U.S.-led venture model is held up as a shining example of the finance industry’s contribution to creative destruction and innovation. The iphone you are reading this on is testament enough. However, the model is not without costs.

Given the risks of the VC model, most companies inherently fail. Because most projects fail, the few winners need to be dramatically outsized. Slow growers are abandoned and early winners are injected with massive amounts of capital. Tens of millions of users is no longer acceptable.

This has unintended ramifications.

It’s a little like steroids. If your competitor uses steroids (i.e. raises US$100m Series B), it’s pretty hard to compete without shooting up. Does it enable super human feats of scaling? Yes. Does it lead to better consumer experiences? Again, yes. Is it healthy for the sport? Eh, less clear. The hyper-growth companies coming out of Silicon Valley or China may create cheap products consumers love, but simultaneously suck the oxygen out of the room in terms of competitive supply.

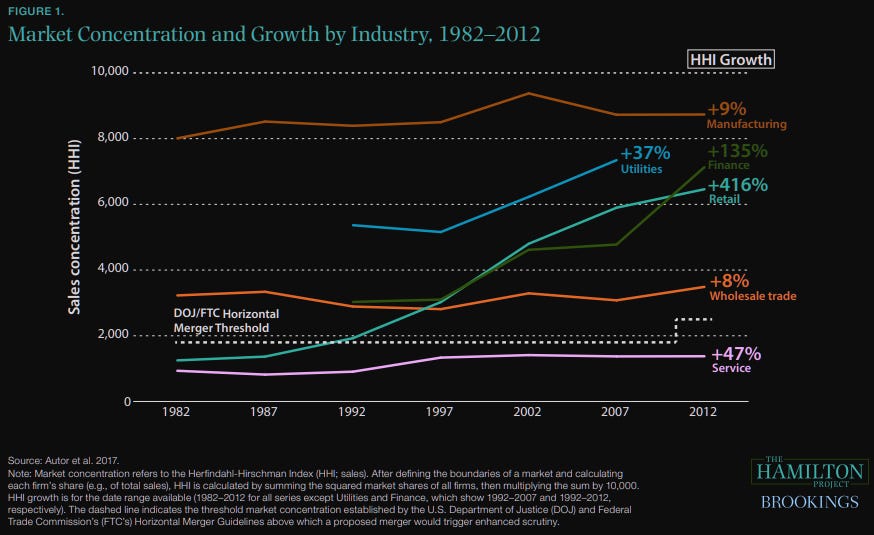

U.S. industries had already been concentrating considerably even before the meteoric rise of big tech.

A financial mechanism designed to perpetuate winner-take-all economics and concentration of market power may only exacerbate the trend. A trend which paradoxically may actually perpetuate declines in rates of entrepreneurship:

In short, the VC model is beautiful, but too concentrated. I’m interested in tools to mimic the effect but in a more distributed fashion - at scale. Of course, most entrepreneurs do not have access to VC funding or have business models which VCs would be interested to fund.

The alternative is debt.

However, we immediately see a few issues. First, Americans have become addicted to debt. While debt can certainly be a tool for growth, it can also turn into a financial trap. With the following figures, it is easy to see how excess debt can weigh on risk-taking and economic dynamism. Call miner lays out the major categories:

Credit Card Debt: avg. U.S. household has approximately US$15k in credit card debt

Student Loans: have reached >US$1.5 trillion with students today averaging ~US$30k each upon graduation

Medical Bills: 41% of working-age Americans are paying off a medical debt or have a medical bill problem

Mortgages: avg. mortgage debt in the U.S. is ~US$150k per household

Auto-loans: outstanding subprime loan debt is US$300b, up 2x from 2011

Many of these loans are now sitting in delinquency.

Debt has become an abused tool. The overuse of which will clearly impact a young person’s decision on whether to join a risky startup or collect a stable salary - further perpetuating the status quo.

Even the few willing to risk it have to jump through many hurdles for a relatively low chance to access funding.

Debt is a relatively poor tool for early or growing enterprises. A nascent business tends to have cash flows disproportionately weighted towards the outer years while debt mandates consistent interim repayments. The inflows and outflows are not aligned. Unfortunately, it is often the only source of funding available.

In short, options for early-stage and growth-stage capital formation have remained largely unimaginative. Small businesses scrounge around before rejection at the hands of a bank or alternative lender - the terms of which don’t match the business trajectory. Alternatively, the handful of startups who can access venture funding follow a power-law distribution with warped outcomes for the employees and the competitive fields they enter. This is the road Asia is going down.

Fortunately, there are new tools emerging which can help fill in some of these gaps between these extremes.

Emerging Models for Asia’s Potential Funding “Leapfrog”

This post is already running long, so going to split it in two. However, next week we can explore in more depth a few of the financial tools which are shaking up the existing landscape. Similar to how China has zoomed ahead in consumer fintech, why can’t China, India, and Southeast Asia “leapfrog” when it comes to creative funding options and distribution mechanisms for growth stage companies?

Some of my favorite emerging (or re-emerging) products to spice of the status-quo include:

ICOs & Defi

Rev-share-based lending

SaaS-contract securitization

Income share agreements

Equity & income risk-sharing

Capital-as-a-Service

Payment-driven monetization platforms

Spin-ins

and more

While debt and equity will clearly still be the main tools, more proper alignment of incentives, differentiated deployment or reach, less concentrated risk, minimized dilution, and more make these solutions interesting compliments. Compliments which may increasingly come to be housed under the same roof.

Similar to how private equity titans like Blackstone have evolved into multi-asset managers, some leading VC funds will likely do the same. Yes, the ever-growing thirst for management fees is a factor, but breadth also provides differentiation when approaching top companies. As large VCs bring ever more tech capabilities to sourcing, underwriting, and analytics, why not expand into new lines of business via acqui-hires and partnerships to provide a more full-service capital offering and amortize the upfront investments over more income streams?

What if the next generation of venture and growth funds look more like tech companies themselves with access to permanent capital, more automated decision-marking, and more real-time deployment - integrating with a number of other platforms to supplement an equity injection with a wider array of products tailored to a portfolio company’s needs? Not only would their value proposition increase but the scope of companies to engage with could expand dramatically.

There are plenty of hurdles to cross between that world and today’s experience of accessing funds in Emerging Asia. Instead of blindly following the U.S. model and raising the ten-thousandth venture fund, maybe managers can take the lead from entrepreneurs and think about how the process could be different.

***

Emerging is a weekly newsletter going deep at the intersection of tech & finance in Emerging Asia. Subscriptions are free of charge and delivered to your inbox every Friday.