Chasing Ant

Aspirational Finance, Second-Level Thinking, and Why China is Different

Durian’s weekly thought to Ponder: “Given market moves since March, do you think Howard Marks wishes he had jumped from 2nd-level thinking… to third?

You guys know I couldn’t pass up on Ant’s S1…

This week, we explore:

Ant Group’s Journey - the poster child of swallowing the financial value-chain from the point-of-sale

My thoughts on Ant’s upcoming offering caveated by a few key risks

2nd-level thinking meets the competitive landscape: Aspirational Ants and why the next wave in Emerging Markets will be different

A month back, I wrote about “blitzscaling-credit”. About pure lenders being poorly positioned in lending. About leveraging payments to swallow the financial value-chain from the point-of-sale. Basically, I wrote about “the China Model”. As opposed to the bank-card, centric model of the late 20th century US….

Today is different. And the relative power between banks and internet companies in the emerging world is shifting. In a world where cash is concentrated in a few internet champions with large, smartphone-equipped user bases and limited digital payment penetration - concentration and vertical integration of the fintech value-chain seems more likely. There becomes a real possibility to wrestle power from the banks, build an alternative network, and swallow the financial supply chain from the top.

“The China Playbook”.

Instead of payment processors / gateways (Paypal, Stripe, Adyen), mobile payment solutions (Venmo, Square Cash), consumer lending (Affirm, Lending Club), SME lending (Kabbage, Funding Circle), crowd funding (Kickstarter), credit scoring (Credit Karma), savings account (Chase, Max), asset management (Wealthfront, Robinhood) all hosted by different parties…

in China… it’s Ant.

Lucky for us, the fintech juggernaut’s S1 was released last week in preparation for its pending Shanghai / Hong Kong dual-listing. If you want to see what it looks like to swallow the financial value-chain from the point-of-sale, look no further…

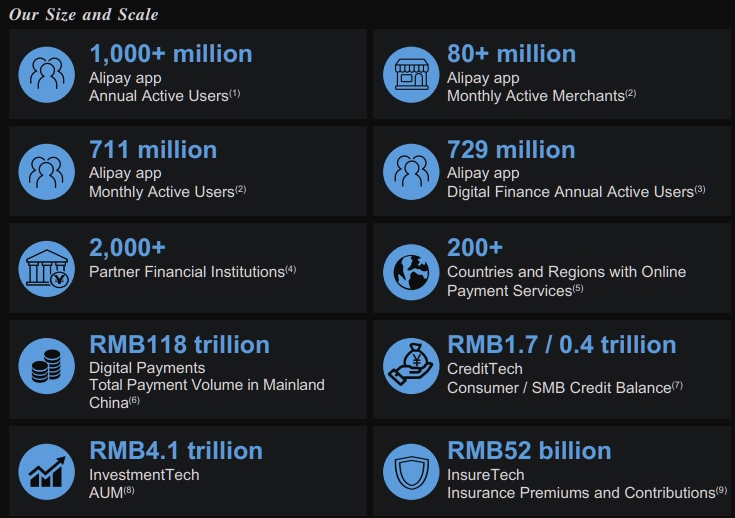

Ant has amassed 1 billion users, 80 million merchants, 2k+ financial institutions, and a thriving suite of credit, insurance, asset management, and affiliate marketing solutions… all tied together by a 21st century payments network supporting RMB 118t (~US$17 trillion) in payments. Yes, the payment flows through AliPay are greater than the GDP of China and soon to surpass the US.

A financial power-house with deep moats from its payments network and multi-sided aggregation effects: the 80 million merchants want access to the 2k+ financial institutions who want access to 1 billion consumers who want access to the 80m merchants… and vice versa. The virtuous loop is accentuated by the unparalleled volume of payments data - honing lead generation, underwriting, and fraud management.

Ant, leveraging its payments network, has parlayed itself into the king of distribution. What Facebook is to DTC, Ant is to financial products. A classic aggregator, but even more impressive in a regulated environment. A value-chain that has proven uniquely difficult to consolidate in the west. If you are a merchant, a lender, an asset manager, an insurer, or any other financial services provider - chances are you must go through Ant to meet your customer.

With ~55% share in digital payments (volumes) and a “tech-services” distribution fee on most financial services offered in China, Ant has truly swallowed the financial value-chain.

The Journey

Ant provides a lens into the evolving financial needs of the Chinese consumer in the new millennium. A microcosm. We can draw on the timeline from the S1:

Please excuse the “ponderfication” of BABA / Ant’s management thought processes below:

2004 - “Wow, Alibaba’s B2C eCommerce is really seeing strong growth, but the logistics of cash-on-demand is very expensive. Wouldn’t it be awesome if we had seamless online payments? Ya, but credit card penetration is very low. Trust in online purchasing is even worse. Maybe we should go with a novel “escrow” payments solution to enhance trust online?” Insert AliPay!

2009 - “Wow - this iPhone thing is a game changer. Did you see Google launched Android last year as well? This could be big!” Insert AliPay mobile app! - perfectly positioned to ride China’s mobile decade.

2010 - 2011 - “Wow - everyone wants a smartphone, and they are using them to buy more online! Ya, but the offline market is still way bigger - do you think there is a way we can use the smart phone to let people pay offline?” Insert QR code! - expanding AliPay’s use cases offline with very low MDRs & limited hardware costs to lure in cash-favoring offline merchant partners

2013 - “Hmmm - we have this awesome payments network forming… eCommerce is really driving online payments and offline merchants / consumers love our QR code solution. There’s actually a good amount of money just sitting in peoples AliPay accounts waiting to transact. It’s also expensive for us when they cash out to their bank. Is there a way we can incentivize them to keep the money in the Ali ecosystem?” Insert Yu’eBao! - luring deposits away from the banking system and into the Ali Ecosystem with money market yield.

2014 - “Our flywheel is really cooking now. How can we pour fuel on the fire?… Um, credit seems like a pretty obvious next step, right? Penetration is very low relative to the US / EU, but credit cards are pretty 20th century. Maybe we go virtual?” Insert Huabei! the new virtual credit card.

2015 - “Huabei is great! People love this paylater product, they are spending more, and our non-performing loans are quite low. Millennial moms who buy xiao long bao on Tuesday’s between 6 - 8am in the northwest neighboorhoods of Hangzhou in November are particularly good at repayment. Maybe we should give them more?” Insert JieBie and Zhima Credit! - a virtual loan for larger purchases with an accompanying credit score for proven customers. “Great idea! Oh, and be sure to tell our lending partners, not only are we on our way to the most robust payment data-sets of all time, but… the contractual default is we can reach into the eWallet account or Yu’eBao money market balance and automatically deduct owed payments, so our NPLs (even in a pandemic) for both SMEs and consumers will float between ~1 - 2%…. they will love it!”

2016 - “Did we mention we were environmentally conscious and aware of the severe pollution problems many of you are dealing with in our congested cities?” Insert Ant Forest! - a tree planting mini-program to gamify / incentivize limiting carbon-emissions in daily life

2018 - “Wow! Look at this rapidly expanding middle class - they all love to travel and shop! Ya - and now that they are more financially secure, they are thinking about managing risk. Wouldn’t it be cool if we allowed cross border payments / remittance as well as mutual aid insurance products?” Enter Ant-chain and Xianghubao!

2020 - “Geez - our network is really something else. 80 million merchants and 1 billion customers all transacting seamlessly and accessing financial services. I wonder what else can we do with this connectivity? Hmm… those guys over at Meituan seem to be onto something. They are now valued at ~US$200b! That affiliate stuff doesn’t look so hard….” Insert Daily Life Services!

Which brings us to today.

The Offering

A US$200b fintech behemoth serving as the “capillaries” of the Chinese (and increasingly global) financial system - a dominant multi-sided platform connecting merchants, consumers, and the “main arteries” (i.e. the financial institutions) - on its way to:

>US$20b in 2020E revenues, growing >20%+, sporting 59% gross margins and 34% operating margins (margins which will continue to expand as digital financial services revenues surge past payment revenues)

Being valued at ~10x LTM revs (as of 2020E)… compared with leading payment comps currently at ~8x - 10x NTM* revs…

And considering where the public markets are right now (Tesla at ~US$400b…ZOOM popping 44%… Afterpay & Square on a tear despite SMEs in the dumps…SPACs everywhere)…. I think this will be very warmly received by the markets... if things hold on…

Considering the dominant competitive position (~3x the loan and AUM facilitation of Tencent), the moats from the payment network (~55%+ share), the relationship with BABA (dominant #1 eComm), the runway for digital financial services in China (25% credit card penetration, ~3x less insurance penetration , and 4x+ less non-cash investments as % of total ) relative to the US, the not insane valuation, and the multiple growth adjacencies on the roadmap…

I’m a buy.

However, it’s not without a few risks.

The Risks

Pundits may talk about competition from Tencent (~40% share in payments, much less in fin services). They may talk about caps on APRs for partners. They may talk about market saturation. They may talk about corporate governance. They may talk about the very real potential conflicts of interest between Alibaba and Ant.

In my mind, the single biggest risks here are regulatory. 1) Anti-Trust and 2) DCEP (China’s in-pilot digital currency). Neither strike me as immediate.

As for anti-trust, from Reuters:

China’s top antitrust agency is looking at whether to launch a probe into Alipay and WeChat Pay, prompted by the central bank which argues the digital payment giants have used their dominant positions to quash competition, sources with knowledge of the matter said.

Despite the headlines, my sense is this is less of a near-term risk for a few reasons:

AliPay and WeChat Pay essentially run their payments businesses at breakeven with some of the lowest merchant discount rates in the world and then monetize financial services; the reason all-cash merchants elected to join them in the first place. So far, there is limited pain felt by consumers or merchants and plenty of benefits.

Beijing will be keen to show Shanghai and especially Hong Kong (post national security law) are still global financial hubs. They will not want to derail one of the biggest offerings in China’s history. The probe will simply have to wait.

As I mentioned in Technology-Governance Fit, my sense is, assuming no harm to consumers / merchants (see #1), Beijing will be fine to have a dominant platform (under it’s jurisdiction) controlling and monitoring payment flows. It certainly beats the transparency of cash. Well… at least until they roll out…

The DCEP, though early, strikes me as the biggest over-hang to Ant in the medium to long-term. The Ant network is powerful, consumer behaviors established, partner integrations built - they will be very hard to displace. The only entity in China capable of taking it on is… drumroll… the CCP. The DCEP is still in pilot stage with much to be ironed out, but I found this article from Equal Ocean informative in diagnosing the potential “co-optetiion” between DCEP and Ali / Tencent.

My sense is - once rolled out - the DCEP may take some share on the back of a strong government push - particularly in offline use cases given mandated acceptance, no need for internet access, and no transaction fees. The lost payment volume will cut into Ant’s moat (growing network -> more payments -> more data -> better underwriting / lead gen -> more partners -> more cash to grow network) and may allow for more direct competition from banks and other FIs through different rails over time.

However, the ecosystem, the talent, the tech, and the established consumer behavior built by Ant over the last 15 years, will be very hard to replicate. Without an outright government mandate, dethroning Ant as the capillaries to China’s financial system seem implausible. Ultimately, I suspect the government will find working with / through Ant will provide the most seamless path to implementing its vision.

The Opportunity: Emerging Asia & the Aspirational Ants

As stated in “Blitzscaling Credit”, I still believe payments will be essential to carving out lending profits long-term:

Payments are the network, the moat & the data all rolled into one. Without payments, the other prizes dry up. Unlike lending, eWallets follow a power-law distribution - with 1 or 2 capturing most of the market - which is why tech titans are prepared to spend dearly to get their flywheel going….

In a digital world, successfully blitzscaling payments becomes the key to sustainably profitable lending...and then insurance…. and then asset management. And as we witnessed in China, payments tend to follow winner-take-most economics.

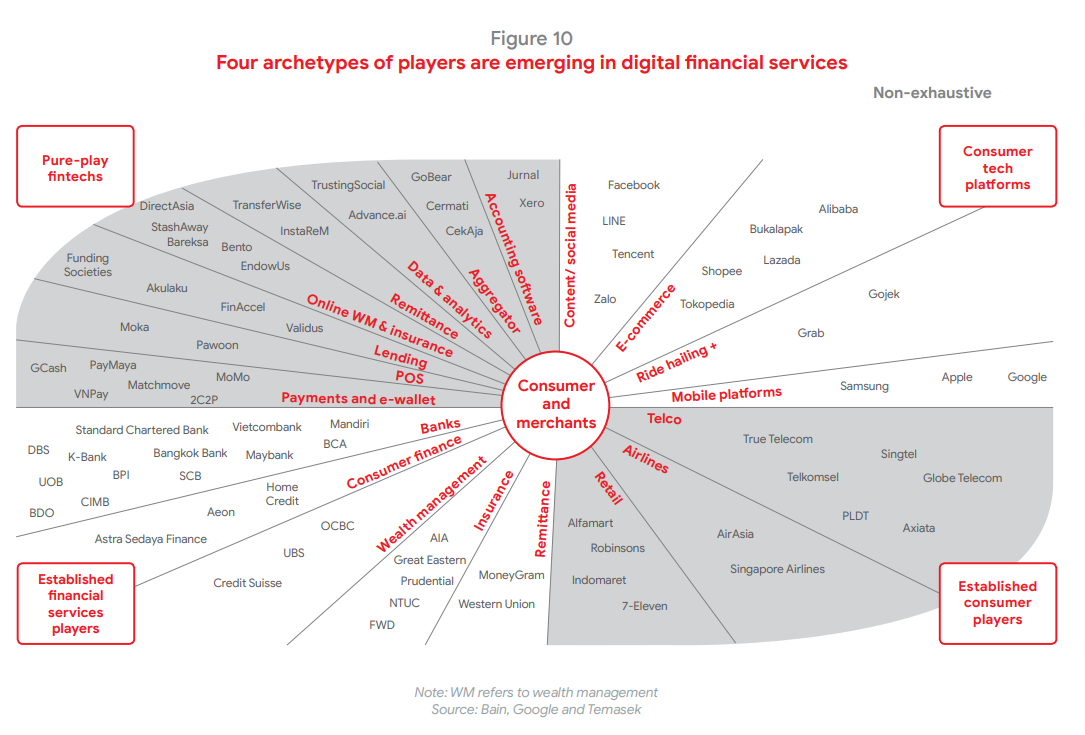

Now everyone in India and Southeast Asia is chasing Ant. They see the US$20b in revenues, compare their own digital penetration curves to China’s in 2010, salivate over the myriad unbanked / underbanked consumers, and are licking their lips. Why not us? Why can’t we blitzscale the payment network and then milk it with digital financial services? Judging by the swarm of eWallets - OVO, GoPay, ShopeePay, GrabPay Momo, ZaloPay, GCash, Paymaya, TrueMoney, PayTM, JioMoney, PhonePe… - many are trying exactly that.

No brainer right?

Now is a good time to borrow from Howard Mark’s “Second-Level thinking.” A lens to look past the obvious facts and incorporate the psychology of the other players looking at the same facts into our own calculus. From his book:

“First-level thinking says, “It’s a good company; let’s buy the stock”. Second-level thinking says, “It’s a good company, but everyone thinks it’s a great company, and it’s not. So the stock’s over-rated and overpriced; let’s sell”

First-level thinking says, “Look how the landscape turned out in China. Look at how dominant Ant is. Look at how similar our infrastructure and digital penetration are to China 10 years ago. Let’s go invest in the Ant of _____.” Second-level thinking says, “Look at how it played out in China. Look at how everyone else is also looking at how it played out in China. How will it play out differently here now that everyone has seen what I see?”

The thing is… everyone else is reading the same S1 as you. Investors, imitators and competitors. And they also want a piece of the action….

My assessment is Ant is unique. A perfectly timed collision of China’s smart phone rise, piggybacking on a uniquely dominant eCommerce platform, while existing FS incumbents were very slow to react. Because this was the first time the financial value-chain was swallowed, no one else knew how big it could get.

Awareness is now much higher and therefore competition more cut-throat. Banks, FIs, lenders, internet platforms, and other fintechs are scrambling to protect their turf to avoid being swallowed. I’m not saying it can’t happen; I’m just saying it will be harder.

Additionally, while governments are keen to have strong digital payments infrastructure, they are also keen to avoid a payments monopoly. Various initiatives, from UPI in India to standardized QR codes, will make it more difficult to have a payments monopoly. In many geographies, banks have had more time to digitize their offerings and push debit penetration. All of this means Ant’s current ~55% share in digital payments will be much harder to replicate.

With payments being the backbone of the network onto which other services can be layered, fragmented payments mean a fragmented value-chain which means more fragmented profits.

Chasing Ant may prove more difficult a decade later.

Emerging is a newsletter going deep at the intersection of tech & finance in Emerging Asia. Subscriptions are free & delivered to your inbox weekly. Prior musings can be found here.