Peak Reflexivity

Why markets are just as fallible as humans

“What is scarier than a centrally-planned economy? Perhaps one that abdicates capital allocation entirely…”

Morning all,

No prolonged intro’s - just a thank you to the few of you who provided feedback on the intricacies of Chinese monetary policy. Very informative. I’m impressed by the caliber of the readership here. Now for what you came for…

This week, we explore:

Human Fallibility & Reflexive Systems - George Soros vs. the Efficient Market

Big Tech Reflexivity: where aggregation theory marries investor collusion for power-law returns

Structural Reflexivity: index investing, the abdication of underwriting, and momentum’s tipping point

Existential Reflexivity: monetary & fiscal policy loops at the base layer of our dream within a dream

My own view for risk mitigation and why the markets have room to run

“In the short run, the market is like a voting machine — tallying up which firms are popular and unpopular. But in the long run, the market is like a weighing machine — assessing the substance of a company”

Benjamin Graham’s timeless quote is now enshrined in the value investing canon. A sacred prayer for the hoards who flock annually to Omaha for the famed “Woodstock for capitalists”. An undisputed truth.

But surveying the landscape in 2020, I find myself uttering the ever-dangerous words: “What if it really is different this time?”

What if, in our brave new world, the short-term has a very real impact on the long-term? What if, over time, the voting machine can tip the scales of the weighing machine? What if - in the era of network effects, zero marginal costs, passive investing, social media and cheap capital - what if sentiment today has a very real impact on “substance” tomorrow?

The more I look out at the world in 2020, the more I think George Soros is right. Reflexivity is everywhere. Super-charged in an era of global connectivity and instant feedback loops.

For those of you who are unfamiliar with The Alchemy of Finance or Soros’ other essays - I will save you. The writing style is a blend of aspirational philosopher meets 1950s academia. It’s dry. But it’s not wrong.

At its core, there are two tenets to Soros’ vision of the world to which he attributes much of his success in the markets:

Humans are fallible (and because humans are fallible and the market is a collection of human judgements, the efficient market hypothesis on which modern economics rests is incorrect)

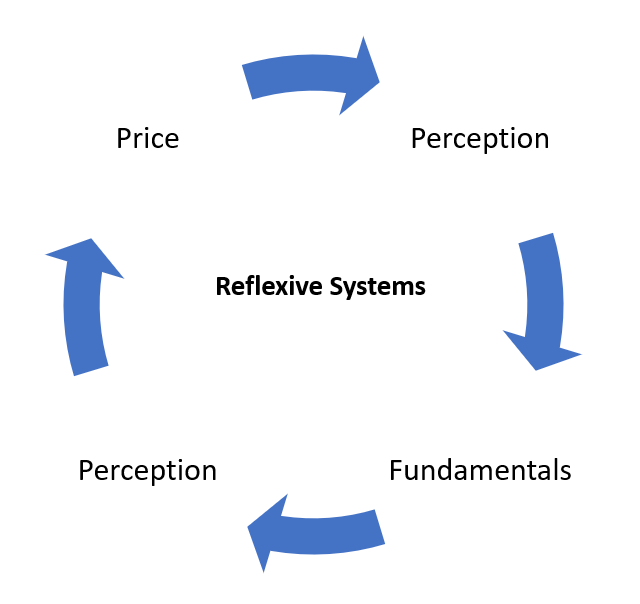

Systems with “thinking” participants are “reflexive” (i.e. humans have agency and can impact the system in which they operate. Feedback loops exist between investors’ (fallible) perception of reality which affect economic fundamentals, which in turn, further impact investor perception of reality).

In drawing the distinction, Soros compares the objective world of physics and natural phenomena…

To the much more convoluted world of social phenomena:

Social phenomena are harder to quantify because the system is dynamic. The financial markets serve as an excellent testbed to explore this complex cocktail of social phenomena: millions of different subjective realities colliding in an attempt to form a quantifiable view of objective reality. This ultimately proves impossible because 1) humans are fallible so their views of objective reality are incorrect and 2) everyone else’s subjective reality is constantly changing which in turn affects everyone else’s. The system is alive.

Reflexivity is an elegant way of explaining booms and busts in the financial markets. As opposed to the “efficient market hypothesis”, humans often act irrationally, on incomplete information, with heavy biases, where the changing views and actions of others constantly require an updating of one’s own views which will then require an updating of their views… and around we go. It’s messy. A corkscrew of subjective realities which can move towards “objective reality” or away from “objective reality” depending on the interaction of participants in the system.

Despite being divorced from the original “objective reality”, investor sentiment can very much have an impact on the underlying fundamentals they try to assess. The relationship between perception and reality is a two-way street.

Spotting reflexive loops at their outset can be quite lucrative. Nowhere has this been more apparent than the rise of big tech.

Anti-Competitive Reflexivity: Big Tech & Implicit Collusion

Big tech’s meteoric rise and dominance - across the US, China, and increasingly, Emerging Asia (see everyone piling into Jio & SE etc) - is often attributed to the internet and the rise of business models with zero marginal costs. Aggregation. By aggregating demand online, supply will seek out demand and the blackhole is formed. Facebook, Amazon, Google, Alibaba, Shopee, Netflix, Douyin, Flipcart, Meituan, Swiggy, Grab etc are all examples of two or multi-sided marketplaces for attention, commerce, rides, delivery, you name it. These businesses generally follow power-law distributions: the ultimate winner taking the majority of share as its flywheel runs away from the pack.

Clearly, the zero-marginal cost nature of these businesses lend themselves to power-law distributions, but that is only half the story. Half the loop in a two-way street. The other half: these businesses lend themselves to power-law distributions because…. well, because we all believe they do. It’s a reflexive loop.

As soon as a network coalesces around a leader, it’s a self-fulfilling prophecy. A shared myth. Not quite on the level of nationality or currencies or legal systems - it’s clearly more fragile. More implicit.

**Looking around the room, everyone’s nodding** The unstated: “Alright guys - we’ve seen this story before, let’s all back ______”.

Pre 2010, this was far from a given. However, since ~2015, investors have seen the pattern enough times in the US and China where the loop has become hard-wired. In Emerging Asia, LATAM and ME, in some ways, the biggest advantage the market leader has is simply…. BEING THE MARKET LEADER.

Similar to shorts smelling blood in the water, piling onto Soros’ trade to break the bank of England, investors pile into breakout companies. If I know everyone else is thinking the same thing, even if I think the market leader may be “expensive” I would be stupid to not join the herd, provide cheap capital to the leaders, and starve the also rans (assuming the market is large enough). Funds like Dragoneer and Tiger Global have made an absolute killing on this strategy. Late-stage growth in tech is hands down the best risk-reward in investing. No tech risk, proven business, large markets, zero marginal costs and a reflexive loop in the investment community: “We have seen this story before”. Let’s do this. The story becomes the story.

It’s easy to make fun of the Vision Fund post WeWork, but Masayoshi Son’s US$100b bet was that he could push this reflexive loop from the digital world into the world of atoms. Capital as a weapon. “With big checks, I can signal to the market. I can ‘anoint’ a market leader and other investors will follow my lead”. For all of the memes floating around, he got dangerously close. We were just a few weeks away from a US$47b WeWork IPO before a couple large institutional investors balked… “wait a sec… this is nuts!” It was one step too far. The reflexive loop came crashing down.

While the Vision Fund wasn’t quite able to bring reflexive loops to offline companies in the private markets, you would be gravely mistaken to think they were exclusive to big tech.

In a way, big tech reflexivity is only a microcosm for the broader market.

Structural Reflexivity: Passive Market Investing

Now take the paradigm above and zoom out. We are now looking at broader market equity flows. It’s no secret there has been a massive shift in the equity markets from active managers to lower fee index vehicles like ETFs which simply track the market. The divergence has been striking with basically ~100% of new flows each year going into passive funds.

It’s hard to get more reflexive than index market investing. By definition, these vehicles invest in what other people have already invested in. For those outside the US where passive is less common, index funds are vehicles which pool inflows from investors and simply buy the companies on the index (say the S&P500) based on their respective market weighting. Cash comes in, they buy each stock in the index pro-rata. Yes - you heard that right: the more a stock price goes up, the more passive funds are forced buyers… because the price has gone up! It ignores objective reality completely and simply trusts the other participants in the market.

But what happens when passive investing passes active investing as the dominant method for capital allocation? Some estimates claim passive has reached as high as ~45% of the US Equities market. Who is… you know… actually deciding where capital should be allocated?

Critics would argue the real share is lower (closer to ~20% of the market) and active investors would exploit inefficiencies if passive becomes too large which is partially true. However, they miss reflexivity. Active managers also see the massive shift to passive which impacts their behavior. Would you rather take a contrarian bet against a relentless tsunami or simply front-run the loop to its logical conclusion? Many are opting for the later…

The strategy only works as a minority within a larger system. But we are reaching a stage where indexing is on its way to becoming the system.

To quote Jack Bogle of Vanguard fame:

“If everybody indexed, the only word you could use is chaos, catastrophe…. The markets would fail”

Similar to the WeWork example used earlier, because there is less of a fundamental floor - the reflexive loop can come crashing down in a hurry. All it takes is a few large guys getting spooked: “this is nuts!”. Like network effects (myspace anyone?), reflexive loops can unwind in a hurry.

You could argue this is what happened in February, when the S&P500 registered its fastest 30% decline in history…

… before central banks stepped in with record stimulus to restore confidence and prop the loop back up. Clearly, passive investment reflexivity is entirely dependent on increased inflows into the equity markets.

Which brings me to our biggest loop yet…

Existential Reflexivity: The Fed and “Taming” Volatility

Zooming out yet again, we see the broader financial markets are perched on yet another reflexive loop. The big tech loop is perched on the passive investment loop which is perched on the… stimulus loop. Each loop bigger and more entrenched than the last which means it will take longer to unwind but the consequences of the unwinding will be increasingly catastrophic. Yes, I know - a loop within a loop within a loop. Anyone have Christopher Nolan’s email?

Below is the monetary and fiscal policy loop propping up the other loops.

To fight the great deflation, central banks introduce liquidity to spur consumption but most of it runs into the financial markets in the form of asset inflation. CBs cut interest rates juicing bond prices which dictates a rebalance to higher-yielding equities which props up our passive loop which props up our big tech loop. Turtles all the way down, as they say.

These loops are only accentuated by today’s hyper-connected age: 24/7 “end of the world” media narratives, Davey Day Trader Global, biased wall street analyst reports, WallStreetBets subreddits, social media outrage and a “do something now!” mentality - all perpetuating hyper-reflexivity. Fundamentals have increasingly left the chat in a “now” world of abundent capital.

For someone who believes the efficient market hypothesis (which appears to be most people based on the flows into passive fund management), I would love to get your fundamental analysis on the price moves below:

At the start of 2020, Tesla had a market cap of ~US$75b

At its pre-COVID peak at the end of Feb, Telsa’s market cap had more than doubled to US$166b

By mid-March, Tesla’s market cap was back down ~2.5x from Feb to US$66b

By the end of August, Tesla’s market cap had jumped ~7x from its March lows to ~US$465b

My inbox will be open.

I’m not against fundamental analysis. It is often crucial. I’m just saying markets are evolving and other frameworks can be additive. I didn’t do any fundamental analysis when buying Tesla in March (I know, self-daps). I honestly have no idea if its “fundamental value” is US$50b or US$500b. I just thought the loops would rebound. The social media loops riding on the big tech loop riding on top of the passive investment loop riding on top of the perpetual stimulus loop riding on top of expectations and public outrage at economic pain. Looking at China’s market, I imagine Emerging Asia’s nascent wealth management industry will be even more hyper-reflexive coming of age in a digital world.

The real trick is spotting the loops early - like Tiger or Dragoneer.

It’s always easy to sit on the sidelines and feel smart because things are “too expensive”. Conservative market fundamentalist have been sitting on the sidelines since “late in the cycle” 2016. And its true, we have reached the ever dangerous part of an extended debt cycle where weird things start to happen; where sentiment is no longer subservient to fundamentals but fundamentals to sentiment. It’s scary.

But in a world where cash and bonds have negative real returns, you have to make a call. My personal view for risk mitigation is to stay away from leverage, run the fundamentals to know your floor, own a significant chunk of gold & BTC as a schmuck insurance put option on the stimulus loop, and know which loops you are riding - looking for signals they are accelerating or slowing down - remaining cognizant that reflexivity can unwind in a hurry.

While my loops are looking a bit more precarious than the start of this year, the tank is not empty. Despite the critics, the USD still has a firm grasp on reserve currency status, the passive loop has room to run, big tech accelerated in the pandemic, human nature is too greedy to settle for negative real returns, and our political structures don't have the stomach for economic pain today when we could push it to the next generation.

I’m betting the band has a few more songs*.

* One caveat on this piece - please note I’m < 30 with a fairly high risk-tolerance and limited near-term liquidity needs. Obviously, this is strictly my (fallible) view and readers should adjust for their own situation or the situation of their clients.

Hope you all have a great weekend ahead.

Always,

Pondering

***

Emerging is a newsletter going deep at the intersection of tech & finance in Emerging Asia. Subscriptions are free & delivered to your inbox most weeks. Prior musings can be found here.