Beyond Debt & Equity (Part 2)

Lagging Financial Innovation - Novelties in Growth Equity, Risk-Sharing, Bootstrapping Networks & more

If you are new to Emerging this week, please note this is Part 2 of a thought piggybacking on last week’s Part 1 - it may be helpful to circle back for context.

This week, we explore:

Rev-share-based lending / Capital-as-a-service and the innovator’s dilemma looming in growth equity

Risk-pooling comes to Silicon Valley - tools for smoothing out the power-law distributions of venture-backed startups

Income Share Agreements - why a shift from debt to equity-incentives and pushing risk to platforms / institutions can be a boon to startup ecosystems

Methods for stoking innovation in corporates - hard to get outsized outcomes without outsized incentives

Crypto’s novel incentives as a solution to the chicken-and-egg problem of bootstrapping a multisided-network

As discussed last week, despite the narrative around the “over-financialization” of the economy, there are pockets which have been drastically under-served by financial innovation. Growth-stage companies in particular have remained subject to the blunt tools of traditional debt and equity where more tailored offerings would make sense. As traced by Carlota Perez, technological revolutions have typically been complemented by financial innovations. However, the latest information revolution has had a disappointing dance partner.

Fortunately, the sands are shifting and tools are surfacing to complement and, in time, disrupt the stagnant status quo. I have grouped the financial innovations into a few broad categories:

New structures (i.e rev-based lending or new asset-securitizations)

New concepts (i.e. income risk-pooling)

New homes (traditional concepts in new locations - i.e. spin-ins)

New tech (i.e. crypto)

Most of these have been around for some time in some form and are not completely new or all-encompassing. However, the use cases within the start-up and growth ecosystems are now starting to gain traction but are significantly behind the information revolution in terms of global dissemination.

By adding these tools to the funding toolkit earlier in the life cycle of a country’s startup ecosystem, the healthier those ecosystems can be - curtailing some of the issues associated with extreme power-law distributions of hyper-growth venture or an over-reliance on debt.

New Structures

Rev-share-based lending

In my opinion, revenue-based lending is one of the most significant trends in growth capital over the last ~5 years and is filling a massive gap between traditional loans and venture capital. Targeted primarily at online businesses with stable & visible revenues - like eCommerce or SaaS (software-as-a-service) - the idea is to fund customer acquisition through future revenues as opposed to equity, while also providing more flexibility relative to debt.

The value-proposition is quite clear:

This hybrid approach has caught on with many companies who may not have the historical cashflows a bank would require or the market size of a typical venture candidate. Unlike many banks, most rev-share capital providers are tech-enabled, automating much of the underwriting process for more rapid approvals. Upon application, the business manager plugs-in their payments / accounting flows for real-time underwriting and can be up-and-running in hours as opposed to weeks.

The customer journey is much more convenient relative to bank loan applications or chasing VCs:

The platform provides flexibility in repayment, convenient access to capital in a hassle free, on-demand manner. The platform can also command attractive returns for sizable LPs based on volume and velocity of deployment given more automated processes. Rates will vary by business risk, but in general the returns to the platform can be quite healthy.

Illustrative revenues & cashflows to the platform:

Because the process is less manual than equity fund-raising or bank loans, it is more scalable. Clearbanc, a leader in the space, has already deployed US$1 billion in over 2200 companies - inspiring a slew of new entrants.

Despite the distractions at industry pioneer Social Capital, this “capital-as-a-service” model is finding traction. Many VC purists critique the model saying early-stage VC is a bet on people as opposed to raw data inputs. I think they are right. Capital-as-a-service is not directly competitive - seeing traction in established, growing companies often with more limited scope and ambitions than hyper-growth venture-backed startups. Furthermore, blue chip VCs like Sequoia or Benchmark are more about signalling and networks than actual capital - an exclusive, luxury brand unlikely to be replaced through automation.

However, I sense early signs of Clay Christiansen’s Innovator’s Dilemma on the horizon. With more automated, cost effective underwriting tools, broader distribution and sourcing, and continued re-investment in the platform, I sense capital-as-a-service platforms moving upstream and taking share from traditional growth equity providers. Whether the ClearBancs of the world or simply a new product or algorithm tweak from large fintech platforms - Stripe, Square, Grab, GoJek, Digi-banks, Ant Financial, Shopify or Jio Platforms etc - hybrid capital options for growth companies will expand. Once the model is proven as effective and low-cost, what is to stop them from encroaching on traditional white glove growth equity over time?

Not much.

As a founder with a proven business model who knows the ROI of every $ of marketing spend - why not shift your funding mix to something less expensive? As opposed to US$20m in equity, many founders will opt for US$10m in equity and US$10m of on-demand rev-share capital; limiting dilution for the same growth.

SaaS Securitization

A similar model is Pipe, an LA-based start-up which is pioneering the securitization of SaaS-contracts. Given the stickiness and recurring nature of most SaaS contracts, customers tend to be quite sticky. Why should software companies need to raise equity to fund growth when their contracted cash flows are virtually guaranteed? Pipe - similar to ClearBanc - facilitates loans to SaaS companies to fund growth now, based on their contracted revenues. While the willingness to pay and unit economics for SaaS businesses in Emerging Asia are still challenging (and therefore difficult for VCs to fund), perhaps contract securitization is the tool needed for entrepreneurs to bootstrap their own growth.

I would expect any eCommerce, SaaS, or other digital business with revenue visibility in Emerging Asia to have access to similar financing mechanisms in the near future - funding more startups, with less dilution & less debt over-hang. Whether this hybrid form of capital comes from consumer tech platforms, pure-play fintechs, traditional venture / growth players or new standalone rev-share platforms remains to be seen.

New Concepts

Risk-Pooling

Risk-pooling and insurance products have been another under-served area of start-up formation. The venture model is predicated on the power-law. I invest in 10 companies, 7 fail, 2 provide a decent return, and 1 (fingers-crossed!) is a homerun that “makes the fund”. While employees may be of similar caliber, there is a lot of randomness in success or failure. Say two similarly talented engineers had graduated from Stanford in 2005 - one joins MySpace, the other joins Facebook. The income trajectory of those two outcomes was clearly very different.

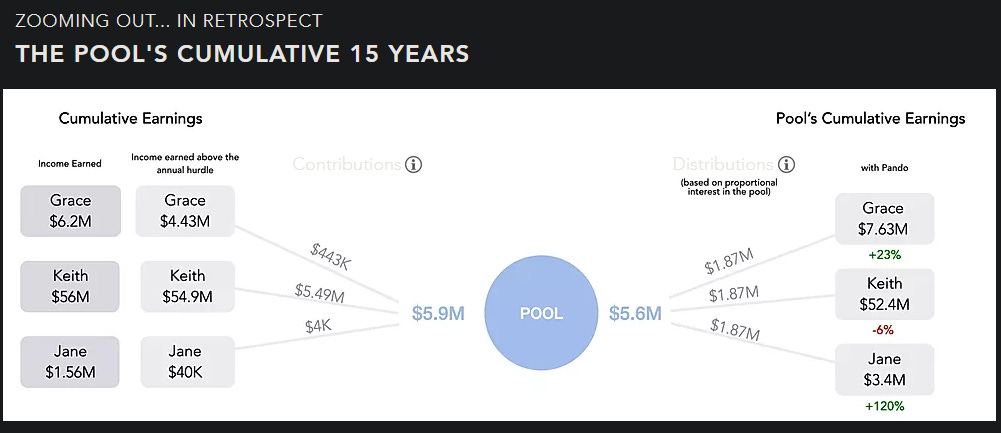

By pooling future income, Pando-Pooling helps to smooth over the extreme nature of these outcomes. The company promotes income sharing between various members of a voluntarily-elected pool in an attempt to diversify risk across non-traditional, high-variance career paths - whether startups, entertainment or sports. Pando allows a group to join together under contract to share a portion (say ~10%) of each participants annual income above a threshold. At the end of the period (say 15 years), the pool is split evenly among the participants.

Pando’s example below lays out one (very good…) possible outcome where each participant contributed 10% of their income above a US$120,000 threshold over a 15 year period:

Clearly, the increase in income to Jane is likely to matter more than the offsetting decrease to Keith. In this way, Pando-pooling can use income-stream diversification to incentivize more risky behavior - leading to more startups created given the downside is cushioned.

As with other insurance models, is there a negative selection bias here? Potentially. Are there issues to smooth-over to avoid the Gen-Z-backed security crisis of 2045? Yes. Is it on the whole good to create tools which limit downside and promote and more shots on goal in our march towards ever higher living standards?

I vote yes.

Insurance pools exist to solve for unpredictable outcomes at the individual level, but often suffer from an agency problem with a large pool of individuals and third-party payers who do not know each other. Why not bring the same economics to a tight-knit group of trusted, capable individuals who are betting on each-others success?

Income-Share Agreements (ISAs)

Another promising equity-like instrument is income share agreements. ISAs would allow students to attend a university at a discount (or at no-cost up front) in exchange for a percentage of future earnings post-graduation. By exchanging debt for equity, the incentives of the school and the student can be more properly aligned.

The looming US$1.6 trillion student loan crisis in the U.S. is a screaming indictment of the existing collegiate funding mechanism. As opposed to saddling students with debt and four years of poetry, why not tie a University’s income directly to the future income of its graduates? Perhaps not completely, but partially. By shifting the risk from the individual to the platform and more properly aligning incentives, the ballooning college expenditures and students graduating with limited career prospects, but large debt-burdens are likely to shrink significantly.

With more experimentation now, Emerging Asia can avoid the depressing cycle of entrapment placed on many developed-economy graduates in the coming years, freeing them up to take more risk.

New Homes

Spin-ins

An age-old struggle for mature businesses is to maintain a culture of innovation despite its size and cash cow inflows. However, the incentives of most large organizations are not structured accordingly. The profile of the 9 to 5 corporate suit and the 25-year-old ramen-eating 24/7 hacker are quite different. Without the upside incentives, why would the latter slave over nights and weekends without the chance at a massive upside? How does a corporate maintain the engine of innovation without the incentives?

Historically, they haven’t…as the continual turnover in the S&P500 exemplifies:

However, with better incentives and a Darwinian culture which accepts extreme outcomes in compensation, I don’t think stasis is inevitable.

Starting in the 90s, U.S. tech giant Cisco Systems attempted an antidote to technological stasis. The spin-in. By splitting off particular teams and providing them with equity-like upside upon hitting set revenue targets for a new product, Cisco birthed a startup ecosystem within the organization, but exclusive to Cisco and with the advantages of its existing infrastructure and large customer-base.

“If X product hits US$50m in revenues in 2 years, we will acquire the business for US$250m. If not, you get nothing”. If you crave startup-like innovation in your organization, start-up incentives will likely yield better results than preaching. Unfortunately, the program has since been discontinued at Cisco citing stresses in company culture.

It’s not easy. If I walk out of my boss’s office on payday with my $50k bonus and swing by Angela’s desk on the way out seeing a US$50m check, I may be less excited about my own. Cultures can be fragile.

However, you are unlikely to get extreme outcomes without extreme incentives.

New Tech (& Governance)

Crypto. Finally, a financial innovation Carlota Perez might agree is a worthy counterpart to the “real” innovation of the information revolution. The modern economy is built on digital networks - usually governed by a centralized intermediary whether a government, a tech company, or a media gate-keeper.

Decentralizing these networks is a game changer.

Like any new technology, crypto has fallen pray to the classic Gartner hype cycle - peaking with the ICO boom at the tail-end of 2017.

But similar to the dotcom bust not spelling the end of the internet, these tools are here to stay. The infrastructure build-out has and will continue to take longer than many expect. However, over time, decentralized networks present an exciting tool to disrupt incumbent VCs as well as the increasingly dominant internet aggregators.

Many of today’s largest companies are marketplaces - think AirBnB, Alibaba, Zomato, Grab etc - which largely rely on big VC $ to burn aggressively to subsidize supply (merchants) and demand (customers) to join the platform. The flywheel is born as merchants are attracted to consumers and vice versa, investors pile into the leader, and the leader burns unsustainably to shut out the competition. The resulting monopoly can then extract rents from the participants to the benefit of the VCs and other shareholders and expense of the merchants and users.

What if there was another way to fund this virtuous cycle? What if instead of relying on SEA, AirBnB, AWS, Bank Mandiri, even the Fed, to facilitate exchange between parties (often with max extraction), we could facilitate similar services by immutable code, distributed governance, and more aligned incentives?

The ICO boom - while getting way in front of its skiis - showcased a possible route. By distributing tokens in the network across participants - users, developers, and merchants - the value accrues across all network participants not just shareholders who also have a say in the governance of the network. Furthermore, because the value of the token grows with the value of the network, users are incentivized to help the network grow. Evangelists.

While early, decentralized networks - whether in payments, storage, compute, social, marketplaces, or lending - hold the promise of bootstrapping network effects in a more distributed fashion.

Instead of Facebook, Amazon, Alibaba and others at the center of the internet and the value accruing entirely to their shareholders, what if ecosystem participants could interact directly, vote on how the ecosystem should be run, and share in the upside of the value of the the network effect they are helping to create?

Utopian? Maybe.

Worth a try? Absolutely.

***

To conclude, my core point across Part 1 and Part 2 above, is despite the consistent narrative of over-financialization of the economy, in reality, the financialization is simply misplaced. Innovation in funding mechanisms for early and growth stage companies have been stagnant. While useful tools, an over-reliance on debt and venture has created warped or over-saturated ecosystems which stifle innovation in the long run. By creating more innovative tools earlier in a company’s life cycle, the finance industry is capable of playing a facilitating role in the beautiful dance of creative destruction.

Instead of playing the leech, finance can return to being the petrol in the economic engine of innovation.

***

Emerging is a newsletter going deep at the intersection of tech & finance in Emerging Asia. Subscriptions are free & delivered to your inbox weekly. Prior musings can be found here.