Deglobalization: Customer Amortization is the new Blitzscaling

Emerging Tech's Rise from the Ashes of the Liberal World Order

Welcome to Emerging, a weekly newsletter exploring the intersection of tech and finance in Emerging Asia.

In a world of noise, there is no substitute for good content.

This week, we explore:

Donald Trump: a surprising boon for Emerging Asian Consumer Internet

The importance of the geopolitical backdrop to tech industry evolution

Why customer amortization is the new blitzscaling

Deglobalization’s sweet spot; why consumer internet will thrive amidst the pull back in globalization

Tell me why I’m wrong:

Email: ponderingdurian@gmail.com ; Updated twitter handle: @ponderingdurian

Deglobalization & Customer Amortization

After three decades as globalization’s torch bearer, the U.S. electorate used the 2016 election to emphatically throw that torch in the mud. The inequality of outcomes was too stark. Middle America was simply tired of watching the benefits of the post-cold war, liberal world order accrue overseas and to coastal elites. They voted in the one man who promised a reversal of fortune for the American working class.

Donald Trump.

“For many decades, we’ve enriched foreign industry at the expense of American industry;

Subsidized the armies of other countries while allowing for the very sad depletion of our military;

We’ve defended other nation’s borders while refusing to defend our own;

And spent trillions of dollars overseas while America’s infrastructure has fallen into disrepair and decay.

We’ve made other countries rich while the wealth, strength, and confidence of our country has disappeared over the horizon.

One by one, the factories shuttered and left our shores, with not even a thought about the millions upon millions of American workers left behind.

The wealth of our middle class has been ripped from their homes and then redistributed across the entire world.

But that is the past. And now we are looking only to the future.

We assembled here today are issuing a new decree to be heard in every city, in every foreign capital, and in every hall of power.

From this day forward, a new vision will govern our land.

From this moment on, it’s going to be America First.

The above excerpt from Donald Trump’s January 2017 Inaugural Address was the exclamation point on rising anti-globalization sentiment throughout the West. Sentiment kicked into hyper-drive by the COVID-19 epidemic. The re-shoring, re-thinking of supply chains, and increased investment in automation at home will have a material impact on developing nations.

Many folks have written Southeast Asia is likely a key beneficiary of trade war tensions. Over the medium term, I’m more skeptical.

Will certain Southeast Asian countries benefit from supply-chains shifting out of China amid US tensions? Yes.

Will many of those supply-chains still pass back through China which will be hit by tariffs offsetting demand? Yes.

Will a trade war create uncertainty, increase trading frictions, and make it less likely that investors will want to invest in high capex initiatives farther from home? Almost certainly.

Will the rest of Emerging Asia be able to follow China’s growth path over the last 30 years? Unlikely.

Unfortunately, 2020 is not 1990. A lot has changed.

The blanket of American security is in retreat, protectionism on the rise, and the urbanization -> cheap labor costs -> foreign direct investment -> manufacturing -> export-led path to prosperity is in question. This industrial-era path taken by the West, the East Asian tigers and then China is closing as the pandemic, automation, and geopolitics collide. In this new environment, replicating China’s growth, under the previous liberal world order, is much less certain.

Over the mid-term, global flows will decline. Foreign direct investment in emerging markets is likely to stagnate creating a dearth of industry formation, employment opportunity, and tax revenues to plow back into education and infrastructure. Much of the traditional economy will suffer.

Emerging Consumer Internet, though, will thrive.

As we will explore, the value provided by tech-enabled solutions is simply 10x+ that of existing solutions in tier IV China, India, or Indonesia. Innovative digital businesses will thrive where traditional investments fall. Oddly, the pull-back in broader foreign direct investment may prove a boon to consumer internet champions who will see an acceleration in digital penetration as the real world lags further and further behind.

Globalization may be seeing a pull-back, but capital flows into emerging market tech champions will remain more than healthy. If other parts of the economy are slower to develop, the market opportunity for internet champions will only grow.

Over the last 30 years, it’s clear technological disruptions have had massive impacts on company strategy & capital formation. However, less discussed is the geopolitical backdrop which informs all three.

The backdrop is shifting. This will have implications on the shape of emerging market internet champions.

Internet Phase 1: Globalization & Blitzscaling

Sitting here in 2020, Marc Andreessen has been more than vindicated. Software has eaten the world. The silicon march from computers to the microprocessor to the modern internet, to mobile proliferation, to the latest frenzy in cloud, data, and AI, has been a juggernaut which has bulldozed industries globally. Atoms have simply not been able to compete with bits. Ever since the coming out party in the 90s…

1990: Birth of the World Wide Web

1993: Mosaic web browser released

1994: Yahoo is founded

1996: Launch of Hotmail

1998: Release of Windows 98, launch of Google

…digital networks have only accelerated. If the 90s were the coming out party, the 2000s were a toast to mainstream adoption, and the 2010s - truly global domination.

Digital networks fundamentally changed the go-to-market and cost-structure in many industries allowing them to reach widely dispersed customers at zero marginal cost.

The TAM (Total Addressable Market) for these new companies grew in lock-step with internet connectivity and was launched into global orbit with the arrival of the iPhone in 2007 and a global push from Android (Meeker):

Internet penetration jumped 2x+ in under a decade to reach 3.8 billion users or 51% of the globe by 2018.

The ability to reach >50% of the world’s inhabitants near instantaneously has clear implications for how businesses and investors should think about resource allocation and strategy. The US internet champions quickly adopted the new doctrine of the emerging internet era: “Blitzscaling” as defined by LinkedIn founder Reid Hoffman:

Blitzscaling is a specific set of practices for igniting and managing dizzying growth; an accelerated path to the stage in a startup’s life-cycle where the most value is created. It prioritizes speed over efficiency in an environment of uncertainty and allows a company to go from “startup” to scaleup” at a furious pace that captures the market.

In the new world of zero marginal costs, network effects, and winner-take-all, the recipe for winning was pretty simple.

It was a landgrab.

By levering it’s first-mover advantage and “blitzscaling” the network as fast as possible, LinkedIn could hit a point of critical mass, effectively shutting out competitors and forming a quasi-monopoly. Global expansion into the whitespace was the name of the game, and the prizes for victory truly unprecedented…

Sure, advances in information communication technology (ICT) where essential to the “blitzscaling” era of tech companies, but it’s important to remember these events do not happen in a vacuum.

The fall of the Berlin wall in 1989 and the resulting U.S.-lead international order provided the foundation on which this global push rested. The era was awash with euphoria, a surging wave of liberalism, and calls for the inevitable “end of history”. Democracy, free-markets, and “we are the world” seemed to be the mantra of the age for the newly-enlightened global citizenry. Foreign investment effectively went vertical for two decades:

Charging forward, with a first-mover advantage, into the new digital, global frontier - alongside capital, supply-chains, people, information and institutions - all at the bequest and under the protection of a U.S. hegemon.

Open. Global. Free.

This was the era in which virtually all of the U.S. tech champions were birthed. In this era, blitzscaling flourished.

That world order is shifting.

Phase II: Customer Amortization is the new Blitzscaling

In a world pulling-back from globalization, the recipe for success is different. As we discussed in a previous post, the “level of aggregation” or matching of supply and demand online is essential to deciphering the market opportunity and competitive threats. For purely digital businesses like social networks, not hemmed in by regulation or physical friction, you only need one network globally. Once escape velocity is hit, competition dies away in the niche.

However, substantial opportunities exist at lower levels of aggregation - regional or even local pools of supply and demand waiting to be matched. Similar to blitzscaling, the strategy in rising Asia is also a landgrab, but horizontally. A land grab for customer mind & wallet share across verticals. Customer Amortization.

“Customer Amortization” - the aggressive acquisition of new users and rapid expansion of offerings across verticals to amortize the upfront cost of acquisition across different profit pools

Like a river, resources and capital will flow to the areas of least resistance. Finding many global networks occupied and tensions rising, emerging market tech champions will flow in a different direction.

In China, protectionist policies blocked U.S. blitzscaling and allowed for the nurturing of local champions - even in purely digital domains like messaging, social networks, and search which tend to be global in their level of aggregation. Because many U.S. companies had sucked much of the oxygen out of the room in terms of global networks, China’s tech champions turned horizontal.

Alibaba and Tencent doubled down on their massive home market, realizing the tools Tencent had used to up-end gaming and messaging, and Alibaba retail, could be leveraged for better customer experience and lower costs in other industries. Once you have a customer relationship - with sticky use-cases, high frequency, and trust - you can cross-sell the customer a variety of new digital solutions. You are their portal to the digital world.

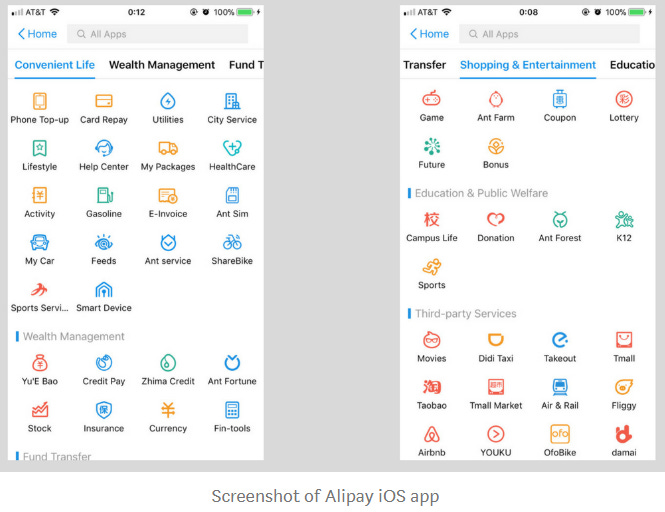

The Rise of the “Super App” is well-portrayed by AliPay’s near universal offerings below:

The strategy depends on how quickly the company can establish a digital relationship with the customer once smart phones proliferate in a given country or region. Furthermore, the impact of the smart phone is inversely proportional to the level of development on the shores it reaches.

The iPhone is amazing, and the difference between the iPhone and the Nokia handset + MacBook combo is a 10x improvement. However, the difference between your first smart phone and well… no connectivity at all… is an order of magnitude greater; especially considering most areas “leapfrogging” to digital have poor infrastructure, 1/10th the physical retail buildout, and limited access to healthcare, education, or financial services in the physical world.

In the absence of physical investment, the digital world becomes even more crucial and ubiquitous. China was the first large emerging country to undergo its transformation - exemplifying just how much digital adoption is possible in emerging markets:

As shown below (Meeker), almost half of the world’s population - China ~(1.4b), India (~1.35b) and Southeast Asia (~650m) - has plenty of headway for continued internet adoption across Tier III & IV cities… fueling the landgrab.

Deglobalization to Accelerate Concentration

The debate around whether India and Southeast Asia will follow a path similar to U.S. tech companies or Chinese tech companies is coming to a close. Blitzscaling vs. hyper-customer amortization. The shift towards greater protectionism will further encourage models and capital formation similar to China.

This is the new playbook for Emerging Asia. The scramble for Super-App status is now on in India and particularly acute in Southeast Asia per the below graphic from the Google Temasek Bain SEA Internet Economy Report.

The original category leaders are rapidly expanding into each other’s domain - in a desperate attempt to own the customer relationship across multiple verticals. Distribution is king.

And the capital markets are complicit. Investors wait for a leader to separate from the the pack and then pile-in. As the cost of capital comes down, the company can spend more on user acquisition, expand into more, newly-digitized verticals, and amortize the cost of customer acquisition over numerous profit pools in a virtuous cycle.

***

In short, the last 30 years of world history has been an anomaly. Localization and rising nationalism represent a return to normalcy. Information flows will be global (mostly), supply-chains more regional (relatively), people flows more limited, and foreign capital flows more selective.

While the potent cocktail of deglobalization, a pandemic, and automation puts strain on the tried-and-true manufacturing led path to prosperity, local consumer internet champions will thrive in the gap.

In our new deflationary world, it is the one, certain place investors will find growth.