Facebook, Jio, Gojek & the Coming War

The Case for a Distributed eCommerce Market Structure in Emerging Asia

Welcome to week two at Emerging, a weekly newsletter exploring the intersection of Tech and Finance in Emerging Asia. While existing coverage is broad, Emerging is for those who want to go deep.

Welcome to ground zero.

This week, we explore:

The bull-case for Facebook in < 140 characters; finally monetizing the social graph beyond advertising

Search vs Social Commerce & the variables favoring the latter in Emerging Asia

eCommerce evolutions from version 1.0 -> 2.0 -> 3.0 and the coming clash of social & eCommerce as previewed by China

Evolving market structures; why spider-web distribution is a better fit for India & Southeast Asia

Facebook, Jio, Gojek & the Coming War

I keep hearing people say Facebook’s investment in Gojek is about payments. The Grab vs. Gojek saga. The battle for super-app status in Indonesia.

It’s not.

At least not exclusively. It’s about eCommerce.

Despite US$71b in 2019 revenues, the Facebook family (FB + Insta + Whatsapp) is drastically under-monetized. Sure, having super-shares, being part of the digital ad duopoly, and rewarding shareholders ~10x in 7 years, provides Zuck with a nice cushion. But in reality, Facebook has left chips on the table.

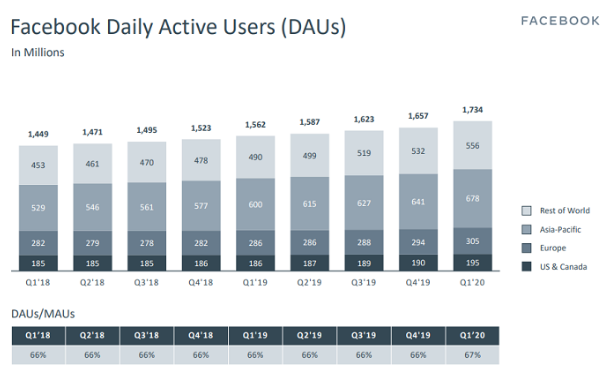

As of Q1 2020, Facebook has 2.6 billion monthly active users.

67% of them come back everyday…

Spending an hour a day on Facebook…(1)

Another hour on Instagram…

And another half-hour on Whatsapp….

With this scale and engagement, Facebook is unequivocally the king of distribution.

A little back-of-the-envelope math:

2019 Revenues: US$71b

Daily Active Users (DAUs): 1.7b

Days per year: 365

Weighted avg. usage / day: ~52 min across DAUs

= 71 / (1.7 * 365 * (52/60)) or ~13 Cents per HOUR…

Compare US$0.13 per hour to other forms of entertainment. Movie rentals. Subscriptions. In-game item purchases. It’s miniscule. And keep in mind this is the weighted average across geographies with monetization heavily skewed towards western users. 13 cents / hour is the bull case for Facebook in < 140 characters.

So, the trillion $ question, we have 2.6b users with ungodly engagement…

What now?

The Payments Adjacency: Burning Down the House

Given Facebook’s scale, the inevitable S curve emerges as user growth is constrained by the number of global internet users. Facebook - predictably - will look for new growth avenues beyond its maturing advertising business.

Payments would have seemed the logical starting point. The “WeChat of the West” was Zuckerberg’s mantra in early 2019. An increasingly familiar story of consumer internet champions now looking to China for inspiration. Facebook has Whatsapp, Messenger, and 2.7b users. Why not layer on payments to complete the web of connectivity?

The thing is - payments is hard.

It’s particularly hard in multiple regulatory jurisdictions; jurisdictions with varying degrees of trust in Facebook’s already less-than pristine reputation. As FT reports, U.S. Senator Sherrod Brown began the Senate Banking Committee review of Libra by describing Facebook as “dangerous”.

"They are like a toddler who has gotten his hands on a book of matches. Facebook has burnt down the house over and over and called every arson a learning experience.”

This is in Facebook’s home market. Not exactly the description of someone who is about to get the keys to the piggy bank. A quasi-decentralized payments solution like Libra is simply too far ahead of its time, and Facebook’s poor track-record and outsider status mean the relevant licenses will be elusive.

Regulatory hurdles aside, payment integration is tedious. To be a true payments solution, you need to be ubiquitous. You can’t just have C2C remittance functionality - clearly in Facebook’s sweet spot - but business onboarding as well. In Emerging Asia where ~90%+ of commerce happens offline, that means going market by market. City by city. Stall by stall. This dirty work is not in Facebook’s DNA.

Fortunately, local champions are emerging in key markets - PayTM in India or Grab / Gojek in Indonesia or GCash in the Philippines - making local digital payments for the underbanked a reality. The Libra project may be stuck, but Facebook is pushing forward with partners who have built on existing rails - Paypal, Stripe, and - soon - the leading e-wallets in India and Southeast Asia. While Facebook will now sacrifice economics at checkout, these partnerships are essential to ensure Facebook can monetize the massive social commerce opportunity on the horizon.

The harsh reality is Facebook has dropped the ball in the west on social commerce through a lack of merchant tools and high-transactional friction. Judging by the Company’s flurry of activity from Facebook Pay, Facebook Shops, and investments into India’s Jio Platforms and Indonesia’s Gojek, Facebook is determined not to let the opportunity slip in Emerging Asia.

Social Commerce - Better late than Never

Fortunately, for Facebook - it has not missed the boat entirely.

Users: Emerging Asia (ex China) is by far Facebook’s biggest market in terms of users and usage with 7 of the top 11 markets (millions of users):

Social Selling is an Established Consumer Behavior: Social channels are still the largest medium for eCommerce in India & Southeast Asia. Since picking up their first smartphone, enterprising SMEs have flocked to the Facebook suite - Facebook, Instagram, and Whatsapp - to find and communicate with buyers. A Nielsen survey of Indian SMEs highlights the pervasiveness of Facebook’s solutions used by small sellers:

Digital Payments are Hitting Inflection: in Facebook’s leading markets like India, Indonesia, Philippines and Vietnam are still largely Cash on Delivery (CoD) markets, but digital payments are beginning to take off. Friction between consumers and merchants purchasing online is beginning to wane:

The perfect storm for Facebook. Shraeyansh Thakur of YourStory in India captures the phenomenon well:

The “Jio effect” has brought millions of Indians online in the last two years, and for many of these new mobile-first users WhatsApp is the Internet, YouTube is television - and personal referrals from family and friends play an outsized role in how they discover new products in this new digital world.

This has turned social platforms into powerful distribution channels for many businesses who are leapfrogging web and going digital with social-first models. Meesho, for example, is empowering more than a million small entrepreneurs to run digital stores on social platforms; while not a perfect analogy, the Shopify for India is being built on social platforms instead of the Web.

The genesis behind Facebook’s US$5.7b investment in Jio - the "AT&T + AMZN + EXXON” of India - is to find the right partner to capitalize on this phenomenon. Jio’s massive telecom investments are bringing hundreds of millions online (~388m subscribers in Dec 2019). The first three apps those newly-minted netizens will download are likely Whatsapp, Facebook, and Instagram (400m+ on Whatsapp alone). Jio’s massive retail footprint is looking to go omni-channel in the digital age. Online purchasing trust is low for new internet users, so social channels are important. And Whatsapp and messenger have emerged as the key mediums for consumers to find trusted products from within their social circle.

The consumer behavior is proven. The market opportunity is massive.

Why not pour fuel on the fire? Why let third-parties capture the economics?

By partnering with Jio (and Gojek in Indonesia), rolling out new tools for merchants, and simplifying user checkout, Facebook can make transacting much more seamless and participate in the economics. It’s a no brainer.

And sets the stage for a showdown with the increasingly dominant aggregators.

The eCommerce Evolution: 1.0 -> 2.0 -> 3.0

Social is the third large iteration of eCommerce:

Version 1.0) 1st Party Retail - Amazon pioneers online commerce, initially as a 1st-party retailer

Version 2.0) Marketplaces - TaoBao (Alibaba) popularizes the “marketplace” model - serving as an aggregator for smaller merchants to reach consumers online

Version 3.0) Social Commerce - social platforms leveraged as mediums for commerce. Facebook, Instagram, Whatsapp, TikTok etc, globally. WeChat, Kuaishou, Douyu, Douyin etc in China.

Clearly, these models have begun to converge and overlap. Amazon has evolved to add a marketplace, Alibaba added T-mall for 1st-party retail and live-streaming functionality. Facebook added “marketplace” back in 2016 and recently Facebook Shops.

The lines are blurring.

The stage is set for a tug-of-war for eCommerce dollars. A massive pie split largely into two categories: Search vs. Social. Push vs. Pull.

While Amazon, Alibaba, JD.com, Flipkart, Shopee, Lazada, and other eCommerce platforms have captured the majority of dollars today with a familiar aggregator playbook (i.e. pull), social platforms are pushing back(2).

The China Internet Clash: A Preview

Chinese competitive dynamics are ahead of the curve and foreshadow the coming global clash. Technode captures the dynamics:

“As e-Commerce and content blend together, shopping and video platforms are becoming frenemies. On the one hand, they rely on each other: Video apps boast traffic and content while e-Commerce sites have brands and supply chains. On the other hand, they are competing to be the central platform for the new model”

All major players - whether eCommerce: Taobao Live, JD Live, Duoduo Live - and social / media majors - like Douyu, Douyin and Kuaishou have converged on short-form video selling.

The explosive growth of Pinduoduo (PDD) in China - ~eCommerce version 2.5 - presents an interesting case study. Through a gamified, social shopping experience, the eCommerce giant has garnished 600 million users and RMB 1 trillion (~US$140b) in GMV in under 5 years. PDD appears to be the first >US$50b success driving eCommerce through a social graph and personalized recommendation engine vs. a traditional search approach. For the unfamiliar:

While PDD is an eCommerce platform with social discovery & customer acquisition hooks, the inverse approach may be more powerful. Social-first platforms have high engagement (leaders approaching ~2 hrs daily) and are better positioned in short-form video, the fastest growing content medium. Facebook and Whatsapp have the entire social graph to leverage. Douyin and TikTok have an intimate knowledge of their users likes and dislikes. The logical next step is pushing products into the ocean of eyeballs.

The Shifting Structure of eCommerce

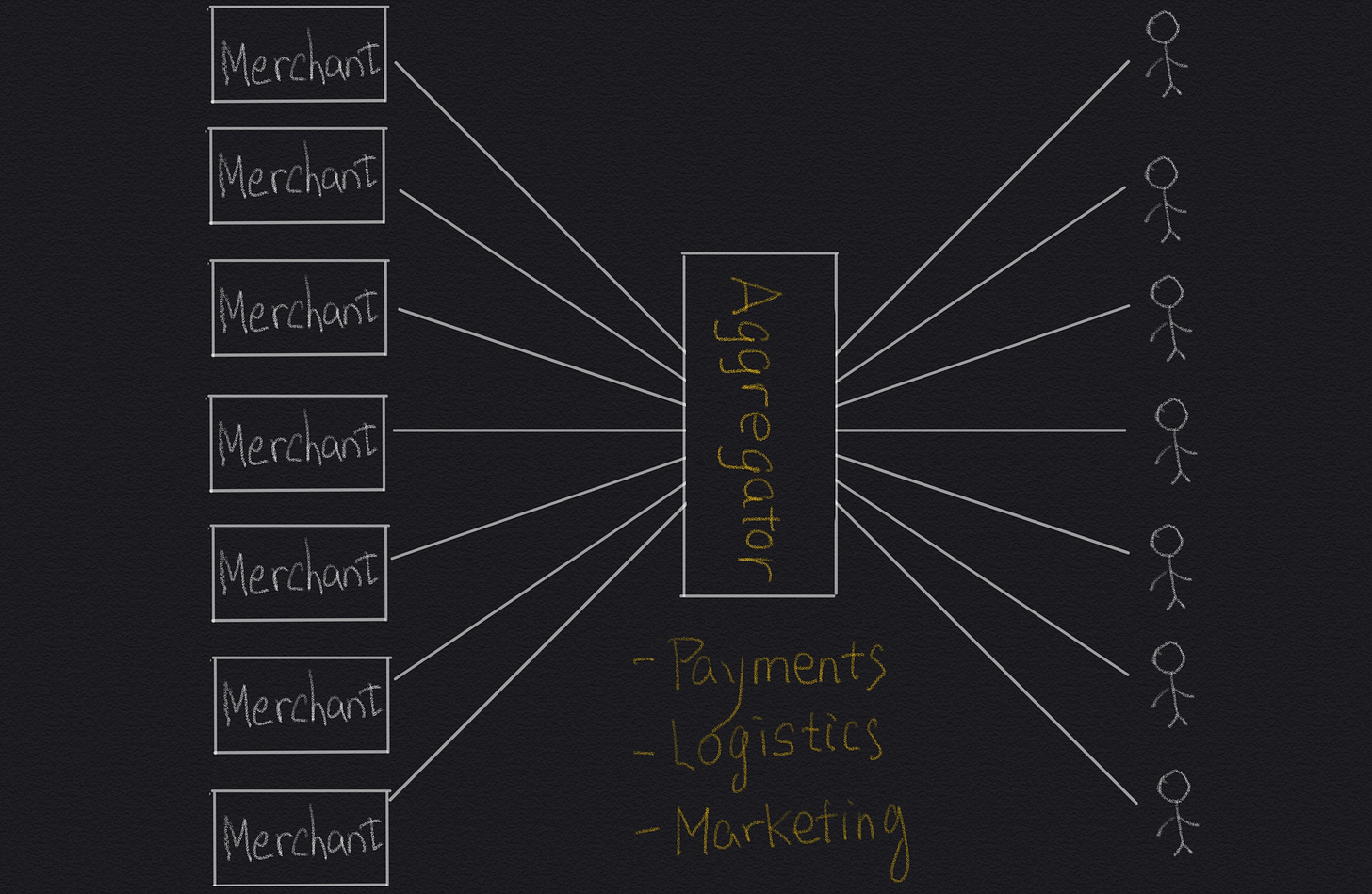

While Facebook is still keen to capitalize on this trend in the west, emerging markets like India and Indonesia are better bets. In Emerging Asia, consumers are more social in nature and traditional 2.0 aggregators like Flipkart or Shopee have lower penetration and less established consumer relationships. As discussed in our prior post, the aggregator playbook is to match fragmented supply and demand online - greased through payments, logistics, and marketing functionality.

eCommerce 2.0 - Aggregator

However, social commerce is different. The below is not perfect, but a rough representation of the shift in structure.

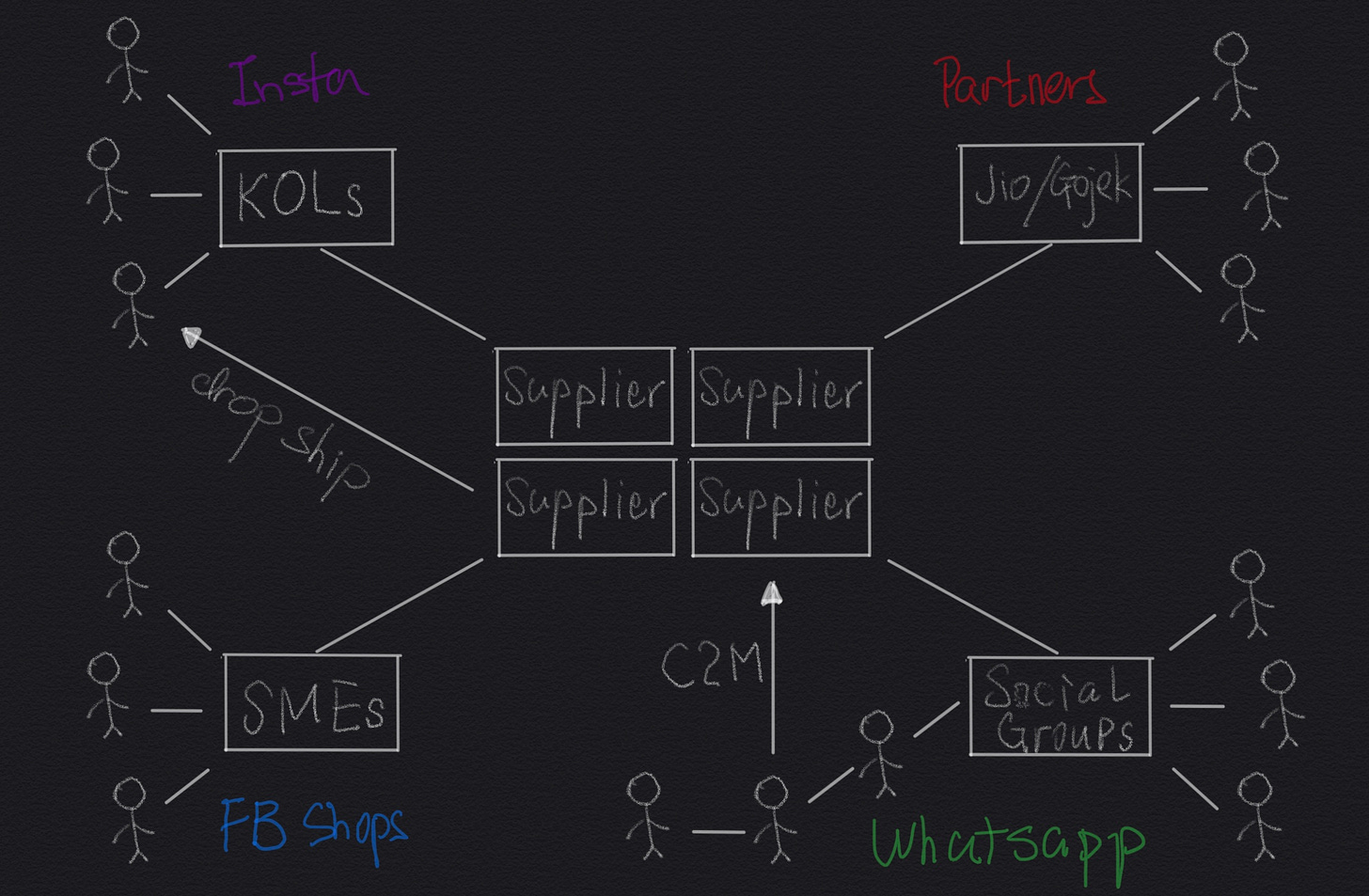

eCommerce 3.0 - Social (Facebook Ecosystem)

As you can see, Facebook’s social commerce distribution will be more distributed and local relative to aggregators. Yes, there will be large KOLs (Key Opinion Leaders) with national distribution drop-shipped from suppliers, but the bigger opportunity is the empowerment of local SMEs (>40 million in India alone). For many of these micro-businesses, this “push” approach - leveraging the social graph - provides an easier transition to the online world relative to a traditional aggregator. Social is a more natural extension of their offline footprint and more closely mirrors the flows of today’s economy.

As highlighted at the end of last week’s post, social commerce can effectively take down the “level-of-aggregation” for many merchants. As opposed to all merchants competing nationally, subject to power-law outcomes - few outsized winners and many struggling - the hyper-local nature of social can ease the burden of competition by localizing the market opportunity. As opposed to roping all merchants into one, centralized aggregator, Facebook’s tools can serve as a spider-web of social ties - infiltrating the local-pockets of demand and trust to facilitate omni-channel transactions.

Facebook takes care of the customer acquisition, allows in-page check-out, partners for processing, and outsources logistics. The latter two are the obvious reasons behind the investment in Gojek. However, the bigger story for India and Southeast Asia is what happens if Facebook finally gets social commerce right?

The market for traditional eCommerce could be a lot smaller than we originally thought.

Footnotes:

(1) From Broadband Search - avg time spent on social media; stats from 2019 so DAUs do not equal Q1 2020 stats

(2) Pun-intended